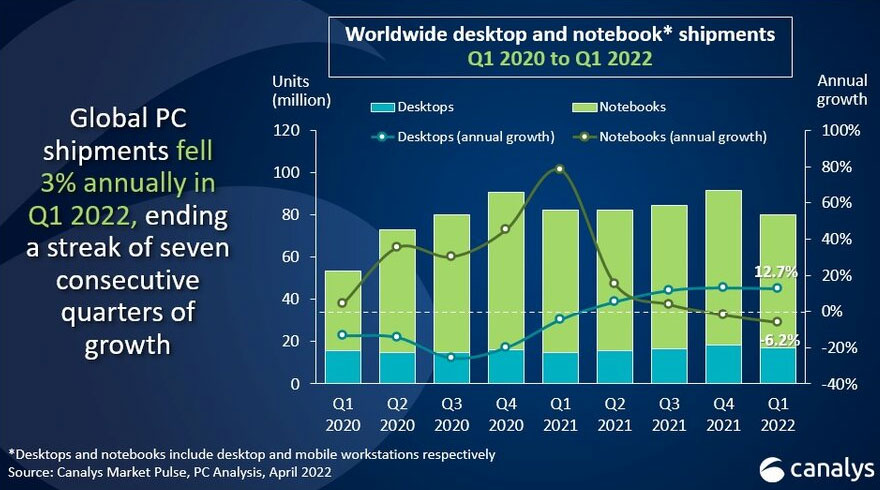

Worldwide PC shipments declined during the first quarter of 2022, but revenues, fueled by enterprise desktop sales, increased during the period.

Despite the first decline in PC shipments since 2020, computer revenues increased 15% during Q1 of 2022, according to global market research company Canalys.

Shipments of desktops and notebooks fell 3%, year over year, during the period, to 80.1 million units, it noted, but revenues hit US$70 billion, as prices continued to rise in a supply-starved market.

Desktop computers performed strongly, with shipments increasing 13% during the period, to 16.8 million units, while laptop shipments dropped 6%, to 63.2 million units.

That drop in notebook shipments may not be as concerning as it appears. “A 6% negative growth despite a massive falloff in education demand implies the consumer segment is as strong as ever, and the PC industry is in a strong spot to continue strong performance in years coming,” observed Canalys Research Analyst Brian Lynch.

“We’ve seen a shift in consumer demand from early in the pandemic, when people were buying whatever laptops they could find,” he told TechNewsWorld. “Now we’re seeing a bigger demand from the commercial segment, which leads to higher-priced devices with higher specs.”

“Enterprises are more and more willing to upgrade devices quickly because they’re seeing they’re an integral tool to their employee’s day-to-day life, especially in a hybrid work environment,” he added.

“We have strong signals that commercial demand will last well through 2022 and into the coming years,” he said. “We expect commercial lifespans to shrink for the foreseeable future. We expect strong performance in the PC industry as a whole, but in the commercial segment in particular well through 2025.”

Chromebook Drop Sinks Totals

A drop in demand for Chromebooks significantly contributed to decreased notebook shipments, according to Gartner. It reported in preliminary figures released Monday a 7.3 percent decline in PC shipments during Q1, to 77.5 million units.

“After an unprecedented Chromebook surge in 2020 and early 2021, driven by demand from the U.S. educational market, Chromebook growth has tempered,” Gartner Research Director Mikako Kitagawa said in a statement,

“It was a challenging quarter for the PC and Chromebook market to achieve growth, as this time last year the PC market registered its highest growth in decades,” he added. However, Gartner noted that, excluding Chromebook shipments, the PC market grew 3.3 percent during the period.

A slowdown in consumer demand also contributed to the slide in PC shipments, as discretionary spending shifted away from devices, Gartner continued, although business PCs saw growth in the quarter as hybrid work and workers returning to the office bumped up demand for desktop units.

“We’ve gone through this cycle where people were buying anything they could get their hands on because it was necessary to stay in touch with their colleagues and friends and family,” observed Ross Rubin, principal analyst with Reticle Research, a consumer technology advisory firm in New York City.

“Now, as more people return to the office, there is more purchasing of corporate PCs, which tend to be more expensive models,” he told TechNewsWorld.

“Because of supply chain problems. buyers may also be buying products at the upper end of their budget, if they can’t get what they need in a lower-priced product because it’s out of stock,” he added.

Consumers Taking a Break

IDC also reported a decline in Q1 PC shipments on Monday of 5.1% to 80.5 million units. The PC market is coming off two years of double-digit growth, it explained, so while the first-quarter decline is a change in this momentum, it doesn’t mean the industry is in a downward spiral.

“The focus shouldn’t be on the year-over-year decline in PC volumes because that was to be expected,” Ryan Reith, group vice president with IDC’s Worldwide Mobile Device Trackers, said in a statement.

“The focus,” he continued, “should be on the PC industry managing to ship more than 80 million PCs at a time when logistics and supply chains are still a mess, accompanied by numerous geopolitical and pandemic-related challenges.”

“We have witnessed some slowdown in both the education and consumer markets, but all indicators show demand for commercial PCs remains very strong,” he added, “We also believe that the consumer market will pick up again in the near future.”

IDC PC research manager Jay Chou explained 2020 and 2021 saw a great number of education projects accelerated to cope with the strong pivot to school-from- home and now that market has reached a lull.

“Chromebooks are expected to really take a plunge in 2022 as many schools have only recently gotten education notebooks,” he told TechNewsWorld.

“Consumers, we think are expected to cool in 2022 due to the very strong pace of purchases that occurred in earlier times,” he added.

“You’ve had a lot of PCs bought for work and school from home,” he continued. “Many families that used to have perhaps one PC per household suddenly needed one for everyone of school and work age. After two years of this, we think consumers will opt for a break, especially in light of inflationary pressures, before recovering a bit in 2023.”

Continued Commercial Sales

Jack E. Gold, founder and principal analyst at J.Gold Associates, an IT advisory company in Northborough, Mass. explained that the pandemic caused a massive need to get computers into kids’ hands, and created a significant uptick in demand, but that has mostly subsided, as those needing machines have pretty much got them by now.

“But there are still a lot of old PCs out there that will need to get upgraded at some point, so the market has not totally dropped off — just got to be more of a normal replacement market after the surge,” he told TechNewsWorld.

Looking forward, Gold sees some reduction is PC demand, but the market is not going to “fall off a cliff.”

“We’ll continue to see strength in the commercial segment,” added Bob O’Donnell, founder and chief analyst at Technalysis Research, a technology market research and consulting firm in Foster City, Calif.

“Companies bought PCs during the pandemic, but there were still questions about what they were going to do,” he told TechNewsWorld. “Now that they have a better picture of that, you’re going to continue to see increased investment. I think we’ll see several quarters of strong commercial growth.”

“Consumer PCs, which have been a big volume driver, will continue to decline,” he predicted, “but the average selling prices will continue to rise and that will help on the revenue front.”