A draconian Covid lockdown and work disruption at an iPhone factory in China might take some of the jolly out of Apple’s holiday season.

Worker unrest at the Zhengzhou Foxconn factory could result in a production shortfall of six million iPhones, just as the holiday season is about to enter the home stretch, according to a report Monday by Bloomberg.

The Foxconn situation is further complicated by protests spreading across China over its zero-Covid policy, which has resulted in residential lockdowns and business closures in many major cities, including Zhengzhou.

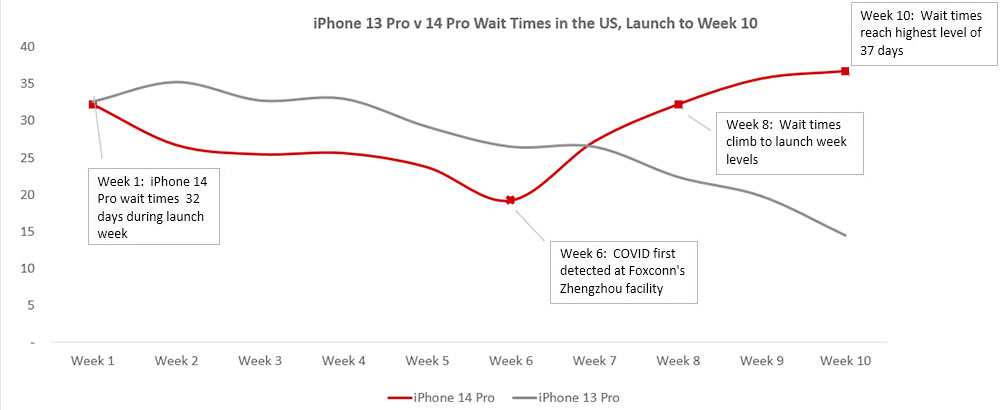

Production delays have resulted in delivery times for the iPhone 14 Pro and Pro Max to be 37 days, according to guidance from Counterpoint Research. Delivery times for the iPhone 14, however, remain at three days.

Meanwhile, Wedbush Securities estimates iPhone production shortfalls during the quarter from 5% to 10%.

“If a holiday gift happens to be an iPhone 14 Pro model, you can pretty much write off the holiday at this point,” said Gene Munster, co-founder of Loup Ventures, a venture capital firm in Minneapolis.

“You may get lucky by going through a carrier. They have some inventory,” he told TechNewsWorld. “It appears that Apple is giving more inventory to carriers than to their own stores.”

Ross Rubin, the principal analyst at Reticle Research, a consumer technology advisory firm in New York City, explained that the carriers’ iPhone inventory was produced before problems in China began to escalate.

“Those problems could have more impact on the carriers as we approach Christmas,” Rubin told TechNewsWorld.

Munster added that inventory might pop up periodically at Apple and other stores, but it sells quickly.

Sophisticated Supply Chain

Tim Bajarin, president of Creative Strategies, a technology advisory firm in San Jose, Calif., cautioned that Apple has not confirmed that current conditions will affect its holiday sales but acknowledged that sources close to the Foxconn factory are suggesting there are production problems at the facility caused by issues with workers’ compensation.

“The bigger problem, though, is the Covid lockdowns,” Bajarin told TechNewsWorld. “Taken together, there’s a real possibility that Apple will be short on delivering the number of iPhones they predicted for this quarter.”

Chart courtesy of Counterpoint Research

“Apple has an extraordinarily sophisticated supply chain capability and is undoubtedly factoring the China factory protests into their ability to deliver products before Christmas,” added Mark N. Vena, president and principal analyst at SmartTech Research in San Jose, Calif.

“There will be some impact, though it will vary from product to product. It’s very possible that some popular products — like AirPods — might see delivery pushed out beyond Christmas,” Vena told TechNewsWorld.

Although the iPhone 14 Pro and Max models may be hard to find, other Apple products don’t seem to be affected. “We’re seeing no supply chain problems with iPads, watches, or Macs,” Bajarin said.

That might change, however. “Today, the problems affect the iPhone, but because 50% of Apple’s revenues come from products produced or assembled in China, other products can be affected too,” Munster observed.

Earnings Call Qualms

Apple’s concerns about potential production problems could be seen during its last earnings call when it declined to give explicit revenue guidance for the December quarter “due to macro uncertainty.”

“Apple’s performance in any quarter is tied to the supply that they can access. To the extent that these problems will detract from production, they could have an impact on their financial results,” Rubin explained.

“The iPhone is the most important product they make from a revenue perspective,” he continued. “In the past, when there have been supply-chain disruptions, they’ve taken a hit to their revenue or claimed they could have performed even better had they been able to access or produce more product.”

“But they also have a very strong track record compared to the industry of ensuring good supply availability,” he added.

Bajarin noted that Apple is very concerned about what is happening in China and its impact on its supply chain. “They’ve already taken strong measures to begin shifting parts of their supply chain out of China to India and elsewhere,” he said.

“Apple has been working with India for over 10 years, although it has only been over the last four years that India has changed some of its policies on foreign investment and foreign control that has allowed Apple to expand faster there,” he continued.

He added that Apple is also concerned with President Xi Jinping’s overall vision for China, which is to be less open to outside markets and more controlled about inside markets, potentially impacting Apple in the long term.

Apple Diversifying Supply Chain

Bajarin indicated that Apple has been working behind the scenes on a lot of different ways to diversify its supply chain.

“They haven’t stated how aggressive they’re going to be, but we’ve already seen the seeds of that, especially when you look at what they’re doing in India,” he said.

There were signs of it in 2021, too, when Apple announced 150 new production locations — 80% outside of China.

“I have to believe that Apple has a solid backup plan in the works that’s going to allow them to speed up their detachment from China at least over the next couple of years,” he added.

A substantial overhaul, though, will take longer than a couple of years, maintained Munster. “It’s a slow process. It’ll take five to 10 years,” he said. “It’s a difficult supply chain to reconstruct in different countries.”

Vena predicted that, eventually, 50% of Apple’s production will be pushed outside China. “Taiwan, in particular, is especially under scrutiny due to the threat of an invasion by China, which would be devastating if that occurred within the next 12 to 24 months,” he said.

Apple isn’t alone in its desire to pare back production in China. “All electronics manufacturers that are heavily dependent on China have been diversifying,” Rubin said. “The Covid restrictions have been a contributor, but there are a larger set of issues that include historical constraints on sales, requirements for technology sharing and reigning in of capitalism.”