The metaverse may have a new place in the retailer consumer experience, but it is off to a dismal start in becoming much of a business communication outlet.

Consumer attraction to today’s metaverse indicates a significant shift in how people use technology. If the metaverse begins to exist and function in totality, marketers clearly should not miss out, notes Marcel Hollerbach, co-founder and chief innovation officer at Productsup, a product-to-consumer (P2C) platform firm.

Hollerbach suggests that it might well become the focal point of change in how we conduct business in the workplace and how we connect with colleagues to complete daily tasks.

According to some early industry accounts, consumers care about the metaverse and are increasing their knowledge of it. In fact, 47% of U.S. consumers can define the metaverse relatively accurately.

That makes it essential for marketers to gain proficiency in navigating the metaverse to reach consumers. Industry watchers estimate that by 2026, at least 25% of people worldwide will spend a minimum of one hour a day in the metaverse for digital activities, including work, shopping, education, social interaction, or entertainment.

If that prediction materializes, organizations will need to grasp the mechanisms of the metaverse and how to market to consumers within it. Much like in the Dot Com era, companies that don’t know how to market with this new tech will be perceived as laggards.

“There are two things brands need to know about implementing their products in the metaverse. First, ignore the pessimistic perspective that the metaverse is dying and not profitable. Second, brands are still actively engaging in the metaverse for product sales and overall workplace efficiency,” Hollerbach told TechNewsWorld.

Business Uses

Meike Jordan, chief people and culture officer at Productsup, predicts that the metaverse will drastically change the 9-to-5 routine in workplaces. The new technology will alter how teams communicate in a post-pandemic world in a major way.

Creating a virtual space for employees in both the office and remote locations to interact is just the surface level. With time, the metaverse can change how employees conduct business, undergo training, and communicate with others, both internally and externally, added Jordan.

However, the metaverse as a business tool is far from being on solid ground. 2022 was a year of experimentation for marketers, and the odds are that will not change in 2023.

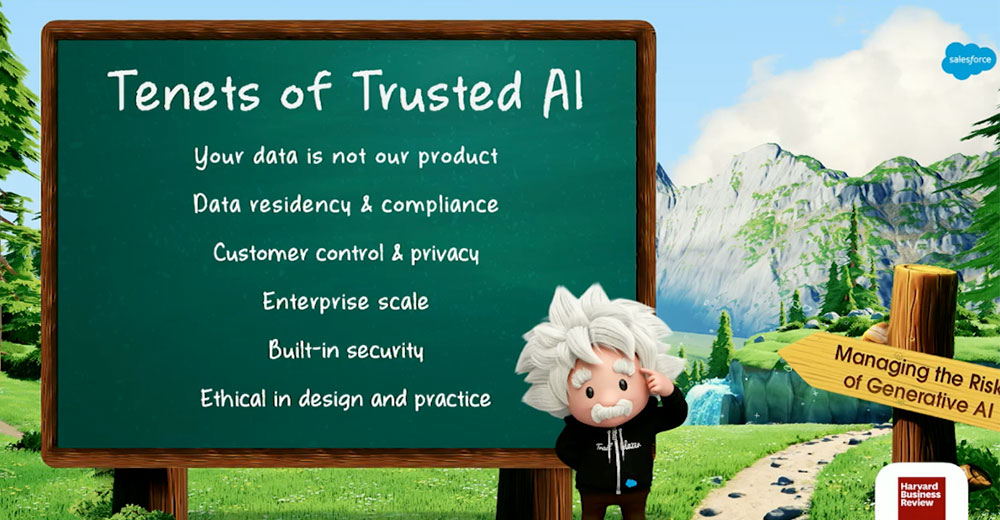

Many advertisers had to hustle to find new ways to connect with audiences. Marketers also had to contend with inflation, economic uncertainty and constantly changing data and privacy regulations, according to Nancy Smith, CEO at Analytic Partners, a commercial mix analytics company.

For this year, she predicts that the metaverse will not be scalable, pushing brands back to real-life experiences. While many marketers have felt compelled to enter the metaverse to explore and experiment, virtual channels will not be the right avenue to attract customers in 2023.

“Audiences have been starved for human connection for over two years, and brands that can leverage engaging, in-person experiences will have the upper hand in the year ahead,” Smith told TechNewsWorld.

Opportunities Still Taking Shape

Brands also need to know that the metaverse is not a quick-gain opportunity, suggested Johan Liljeros, general manager and senior commerce advisor for Avensia, an omnichannel commerce strategy services company.

“The development of the metaverse is a long-term investment. Gen Z and Gen A will be the drivers, and they will grow as that generation becomes a stronger economic force,” Liljeros told TechNewsWorld.

This will affect older generations too, as younger generations introduce them to that technology, he added. He believes that the older generations will use technology around the metaverse, or the metaverse itself, for experiences, travel/tourism, health, and shopping.

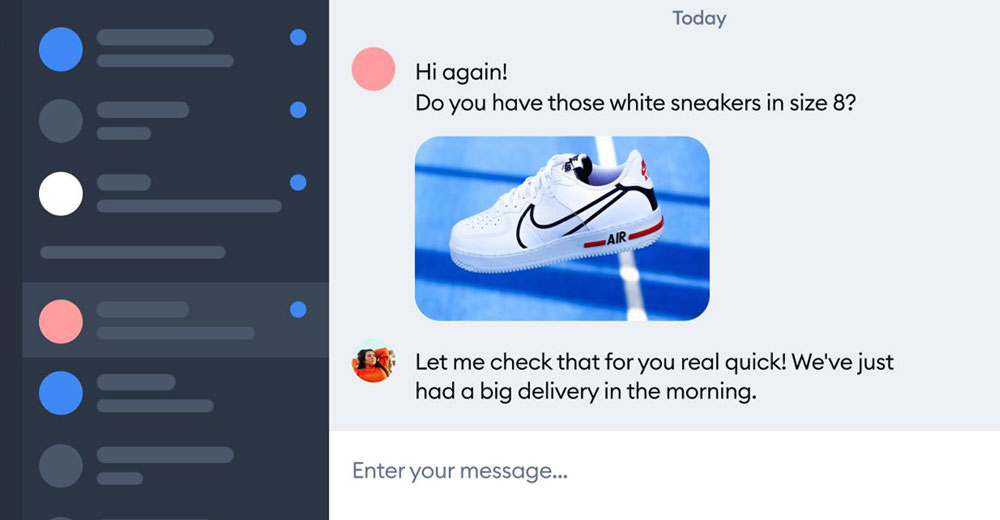

Liljeros sees brands growing their consumer goods sales within the metaverse. Opportunities include selling digital representations of products like fashion and makeup, buying advertising space in games, or AR environments where you can now purchase airspace for your ad or coupon.

“Not only will the audience continue to attract retailers and brands, but the metaverse also makes for a more immersive and social shopping experience where you literally can go shopping with your friends and loved ones,” he said.

Misguided or Lost Technology?

Mark Zuckerberg announced Facebook’s vision of the metaverse in October 2021. Its development is still years away from that vision. Recent moves from Meta have increased the narrative that the metaverse is doomed, given Meta’s losses in the stock market [since October 2021] and the company’s [recent] significant layoffs, observed Hollerbach.

“However, brands need to recognize that the metaverse is a major digital transition, much like the Internet. Once established, early adopters of the metaverse will reap the benefits,” he noted. “Despite all that, Meta just announced it will spend 20% of its cost in 2023 on the development of Reality Labs, which is Meta’s metaverse group.”

From a company culture perspective, the metaverse offers a possible opportunity to solve a major issue that has plagued workplaces since the start of the pandemic — employee engagement, offered Hollerbach. Most employees are tired of staring and talking at a screen with little to no opportunities to interact with one another.

“With the capabilities of the metaverse, normal operations can continue to be conducted remotely, but ‘metaversal’ capabilities offer an opportunity for more employee interaction,” he countered.

Factors for Fixating Marketers

Marketers and retailers recognize the potential of the metaverse, according to Hollerbach. Some 56% of media buyers are investing in metaverse advertising and marketing initiatives or considering it.

The hesitation of 44% of marketers and retailers to fully implement their organization and products into the metaverse is likely a wait-and-see strategy on what the metaverse can do with their product, he suggested. What is missing so far is a standard way for retailers to get involved because the metaverse has not been fully fleshed out yet.

One of the biggest benefits marketers and retailers can count on when they invest in the metaverse is complete control of a product’s online presence. Customers could interact with products, research the brand’s mission statement and goals, and even play games virtually.

“At present, the technology to create such an immersive experience is still under development. But this is the biggest benefit I see for retailers and marketers,” mused Hollerbach.

Changing Traditional Workplace Operations

Hollerbach is confident that after two years of using videoconferencing technology like Zoom, being able to interact with other employees in the metaverse will be a welcomed addition to an organization’s tech stack. It will offer a level of colleague-to-colleague personalization.

But how organizations implement using the metaverse is a critical process. The execution should be done methodically, unlike what occurred at the start of the pandemic.

“It should be used in a way that provides real value to employees. Almost a year after the initial announcement of the metaverse, there are still few concrete examples of consistent ‘metaversal’ uses by companies,” he noted.

By slowly working it into the core structure of remote work and taking the time to understand what works and what does not, employees will become more accustomed to using the technology and more receptive to its purpose. The goal from the start was to increase the level of connection between people.

“By carrying out that goal in the workplace specifically, the metaverse aims to combat employee burnout and videoconference exhaustion, as well as make remote or hybrid employees feel more connected to their organizations,” he offered.

Budget and Timeline

The metaverse is still developing key technologies to make the final product possible. Technologies like 5G, AI, edge computing, AR, and VR are still not advanced enough to create a virtual environment like the one depicted by Zuckerberg in 2021, according to Hollerbach.

Another aspect that is often not touched upon is that this technology should be sold at an affordable price, he advised. Otherwise, adoption will be a lengthy process due to budgetary constraints.

Market conditions are forcing companies to focus more on their core business and less on experiments. This is the main driver for the slowdown in the adoption of the metaverse, he cautioned.

“Some experts are suggesting a date of 2040 when we can begin to see what the metaverse is capable of for ourselves. I believe that is a fair assessment, Hollerbach concluded.