Got Crypto? Make sure you own and have access to it in a secure digital stronghold.

Having self-custody of your crypto keys and managing your digital assets can help stave off digital bankruptcy or loss through theft, warns cryptocurrency storage provider CompoSecure.

Cryptocurrency is an increasingly familiar term since Bitcoin emerged in 2009. Since then, numerous cryptocurrencies have joined the digital asset marketplace and, despite the recent decline in valuations, the cryptocurrency market value has skyrocketed.

Market watchers valued the global cryptocurrency market size at $1.49 billion in 2020. Some project it will reach $4.94 billion by 2030, rising at a compound annual growth rate (CAGR) of 12.8 percent from 2021 to 2030.

The cryptocurrency market represents the start of a new phase of technology-driven markets that can potentially challenge traditional market strategies, longstanding practices in business organizations, and determined regulatory perspectives, according to Vantage Market Research.

Control of Crypto

Cryptocurrencies have the innovative potential to allow people access to a global payment system in which participation is barred only by access to technology. It could replace traditional standards based on having a bank account or a credit history.

However, buying and selling crypto coins and using digital currency to pay for products in the physical world is not the same as opening a bank account and depositing a paycheck. An announcement by Coinbase may have dislodged the elephant in the crypto storage room.

Coinbase is an app that lets people buy and sell various cryptocurrencies — Bitcoin, Ethereum, Litecoin, and many others — and lets users convert one cryptocurrency to another. Users can also send and receive cryptocurrency to and from other people.

In its 10-Q filing last month Coinbase disclosed that it would have the right to hold crypto assets of its retail users as property of the bankruptcy estate, if the company were to file for bankruptcy.

So, what about crypto providers and digital storage centers that hold your crypto funds?

That disclosure is driving awareness and highlighting the importance of self-custody, according to Adam Lowe, chief innovation officer of CompoSecure and creator of Arculus.

“As cryptocurrency is becoming more mainstream, many people are jumping in feet first and not properly researching and educating themselves. It’s important users know how their cryptocurrency works, who owns it, and what control they have with their digital assets,” Lowe told the E-Commerce Times.

Crypto Cold Storage Solution

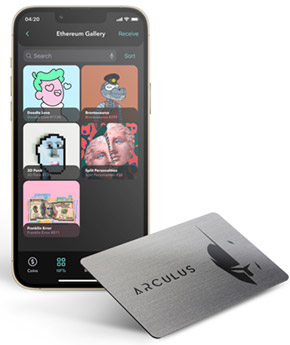

CompoSecure is a pioneer in the premium payment cards industry. The company also developed and provides an emergent cryptocurrency and digital asset storage and security solution it calls Arculus.

The new cold storage wallet solution approach for securing crypto uses the name of the ancient Roman god. Arculus was considered to be the guardian of safes and strongboxes the Romans relied upon to ensure the protection of their cherished possessions.

The company applies that same nomenclature today. Arculus is the contemporary incarnation of this vigilant deity, ensuring the safe, strong security of critical digital assets and identity.

Think of this storage solution as a token, much like the physical device some people rely on to keep their computers under lock and key. For crypto, ownership is directly linked to the owner’s private key.

For example, if you purchase crypto through an exchange and leave it there, you are trusting the exchange to give you your digital assets when you ask. But since they keep ownership of the private keys, the exchange has full control to comply or not comply, Lowe cautioned.

“This is why self-custody wallets are important. By storing your private keys in a self-custodied wallet, such as a hardware wallet, only you have full ownership and control of your cryptocurrency and other digital assets. As we say, your keys, your crypto,” he explained.

Fuss-Free Ownership and Access

Dealing with digital assets is not the same as walking into to your local bank. Crypto security works much differently. When a traditional bank is insured by the Federal Deposit Insurance Corporation (FDIC), if the bank is robbed, defaults, or goes bankrupt, deposits are protected up to at least $250,000 per depositor.

Not so with cryptocurrencies. Those digital assets belong in an unregulated asset class that does not have the safeguards of traditional fiat currency. Crypto is currently not subject to FDIC protection, noted Lowe.

“As of now, if your cryptocurrency is hacked, it is gone. This is the main reason why properly securing and protecting your digital assets offline is important,” he advised.

No holistic regulations governing cryptocurrency exist. That is why cryptocurrency is a highly volatile asset.

“The Biden administration is discussing U.S. regulations. While we expect to see movement in that direction, it could be a while until widely accepted regulations are in place,” he added.

Holding the Right Card

CompoSecure’s recently launched storage hardware wallet enables consumers to have self-custody and manage all their digital assets in one offline place. This approach gives ownership of the crypto keys only to the user.

The company’s innovative solution is the Arculus Key Card which uses a CC EAL6+ secure element to encrypt and store your digital keys. It is not connected to anything. If you lose it or it gets stolen, no one else can use it.

When a crypto owner makes a transaction in the Arculus Wallet App, it requires the user to tap the key card to his or her mobile device. This is an important security step in the three-factor authentication that Arculus uses to keep crypto keys safe and secure.

The card communicates with the wallet app to authorize a tap-to-transact secure near-field communication (NFC). It involves no Bluetooth, no Wi-Fi, no USB, and no cords.

CompoSecure on Tuesday announced the same approach for non-fungible token (NFT) support.

Cashing In on Crypto

Dealing with cryptocurrency issues can become much like a rabbit hole. The more your dig, the further into a financial abyss you fall. To ease the transition into crypto banking, we asked Adam Lowe to shine a light on the subject.

E-Commerce Times: Do crypto platforms provide digital protections?

Adam Lowe: Some cryptocurrency platforms do provide types of cyber or crime insurance, but like most insurance policies there are limitations and loopholes.

So, must consumers understand about the basic guidelines for digital asset ownership and who owns the keys to the crypto?

Lowe: The most important thing to understand is who owns your keys owns your cryptocurrency. Consumers need to educate themselves on custodial versus non-custodial assets.

Additionally, utilizing exchanges or hot wallets that use a continuous internet connection keeps the door open to threats of hacking and theft.

It is also vital to utilize multifactor authentication (MFA). Three-factor authentication is extremely valuable because it ideally looks at something you are such as a biometric, which can be a fingerprint or facial recognition. It requires something you know, such as a personal identification number or PIN.

Lastly, it needs something you have, such as our Arculus Key Card. This added step of security is crucial to ensure only you have access to your assets.

How does self-custody work?

Lowe: That means you own your private keys. The keys are what grant access to full control of someone’s digital assets instead of trusting a third party to be the custodian and arbiter of your digital assets.

Utilizing a hardware wallet, such as Arculus, will provide self-custody as only you can access your private keys and manage your digital assets.

What makes this method different from other custody arrangements with crypto brokers?

Lowe: Crypto brokers and centralized exchanges are third-party custodians. They have control and access to your private keys to purchase, move, and invest your digital assets accordingly. Non-custodial agreements hand over the keys and limit the layers of protection to the end-user.

How can self-custody protect consumers from online hackers and retain their digital assets even if they go bankrupt?

Lowe: With self-custody, no one can access your digital assets without your consent. This provides the necessary level of protection from hacks.

When it comes to an individual user going bankrupt, cryptocurrency is not considered income but rather property. Bankruptcy law is complex and very fact-specific, so I cannot give you guidance on what could happen to cryptocurrency in a user’s bankruptcy.

Is crypto investing for everyone or just those who can afford to lose?

Lowe: Cryptocurrency is currently being adopted at a faster rate than the internet. It is becoming mainstream. For some, it is their first investment venture. But like any investment, there is a risk of loss. As long as people understand the lack of regulations and high volatility, they can invest according to their level of comfort.